Monday, November 24

Sunday, November 23

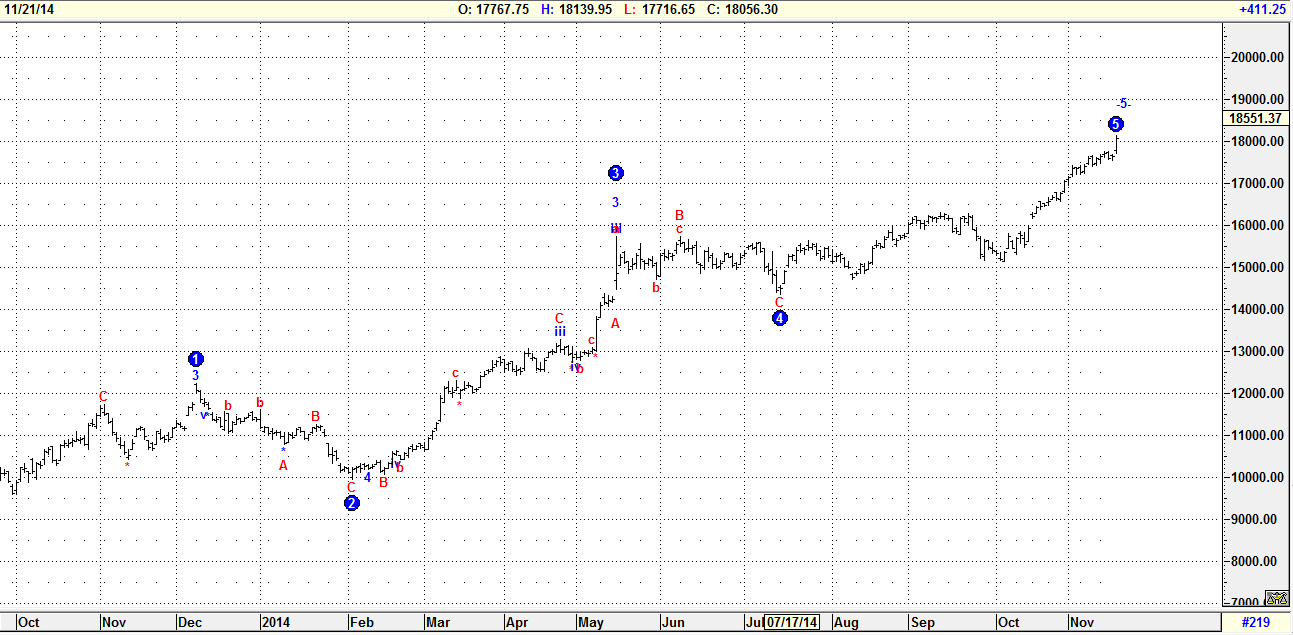

Bank Nifty Weekly Analysis November Expiry

Last week we gave Nifty Chopad level of 17126 . Lets analyze how to trade Bank Nifty in coming expiry week.

Bank Nifty Trendline support comes @ 17700, Bank Nifty can rise all the way to 18500 before any profit booking comes in.

Bank Nifty daily chart is showing impulsive 5 wave..

Continue Reading

Bank Nifty Hourly

Bank Nifty Trendline support comes @ 17700, Bank Nifty can rise all the way to 18500 before any profit booking comes in.

Bank Nifty EW Daily

Bank Nifty daily chart is showing impulsive 5 wave..

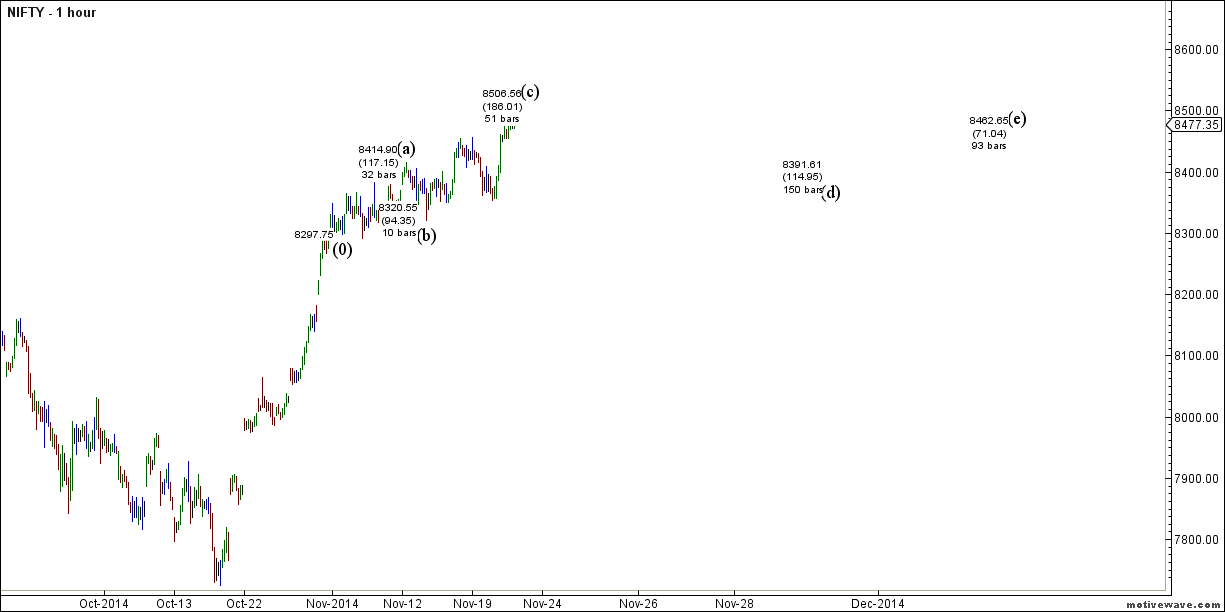

Nifty Weekly Analysis November Expiry

Last week we gave Nifty Chopad level of 8416

Nifty continued with its upward journey and make new life highs.

Reserve Bank of India is scheduled to release the current account

deficit (CAD) numbers for Q2 September 2014 on Monday, 24 November 2014,

also Winter session will start . We have the expiry week so expect

volatile moves.

Nifty Hourly charts has meet its trendline resistance @ 8490,Breaking the same we can see another round upmove till 8546/8597.

Continue Reading

Nifty Hourly Chart

Nifty Hourly charts has meet its trendline resistance @ 8490,Breaking the same we can see another round upmove till 8546/8597.

Nifty EW Chart

EW on Hourly chart is shown above..

Saturday, November 22

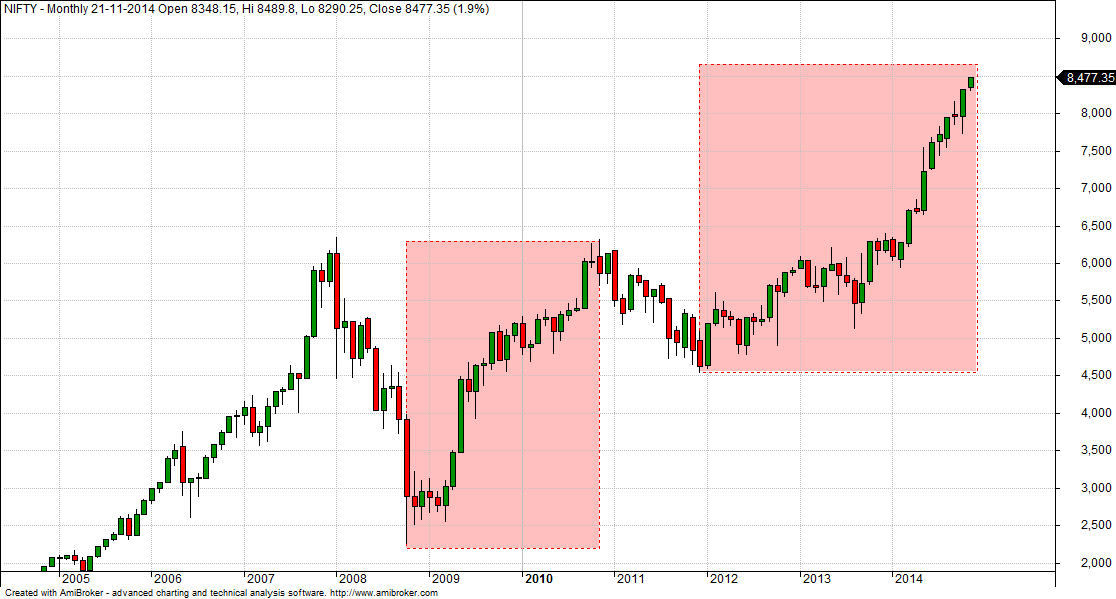

Nifty Box Analysis

Nifty BOX Analysis

As seen in above Nifty Box Nifty made low of 2252 on 27 October 2008 and High of 6336 on..

Nifty medium term view using Gann

As discussed on 15 Oct when Nifty was trading

near 7723 above the possibility of 8500/8700 levels, Targets are on

verge of Hitting..

Nifty has been in correction mode ever since it hit the High of 8180 on 08 Sep 2014, It has been in sideways choppy mode from that point of time.As discussed in our Facebook page we are seeing some big move coming in Nifty.

Using Gann 52 concept , classic technical Analysis I am putting forward the view till end of 2014, use the below view as an input to your trading/investing plan, Do not blindly follow the same, trading is all about probability and we are analyzing one of many probability.

2. Hammer Candlestick formation

Continue Reading

Nifty has been in correction mode ever since it hit the High of 8180 on 08 Sep 2014, It has been in sideways choppy mode from that point of time.As discussed in our Facebook page we are seeing some big move coming in Nifty.

Using Gann 52 concept , classic technical Analysis I am putting forward the view till end of 2014, use the below view as an input to your trading/investing plan, Do not blindly follow the same, trading is all about probability and we are analyzing one of many probability.

1. Trendline Support

2. Hammer Candlestick formation

Continue Reading