Nifty EOD Analysis before Dec RBI Policy

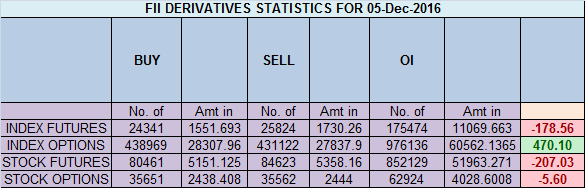

- FII's bought 3.6 K contract of Index Future worth 215 cores ,2.2 K Long contract were added by FII's and 1.4 K short contracts were liquidated by FII's. Net Open Interest increased by 0.07K contract, so rise in market was used by FII's to enter long and exit shorts in Index futures. Why Traders are unable to Follow Your Trading Plan