Nifty Medium Term Outlook

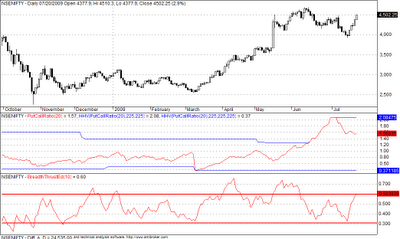

A look at the Chart with the Institutional Money Flow against NIFTY clearly shows a BULLISH DIVERGENCE(Shown in Blue Lines), thus giving more room to the upside.

At the same time the Chart showing the TICK(Advancing-Declining Issues) against Nifty clearly shows Market Weakness after this 500+ Point correction on upside.

The market is facing an imminent downside move in very short term perspective. All shorts should be either covered or hedged at the first major low(Maybe over 3950). Am strictly No-No for longs even after a strong breadth thrust in NIFTY (Chart Attached) because of the abnormally High PCR (Chart Attached). One should judiciously watch for institutional weakness once 4700 is crossed(Yes, this time there seems nothing to stop it).

POINTS TO NOTE: 1.The weakness may develop anywhere between 4700-5200. If one wants to trade that zone from the longside, he must be real real cautious.

3.This is the best challenge for Price Action readers(I hate the term TA)---- sentiments turning bearish, while the rally is sponsored by the HONCHOS----- just place your bet when the Smart Kids are ready to pull off the carpet.

4. The toughest question is what happens if the BREAKDOWN Does not stop at 3900 and continues all the way down? I would suggest everyone to join the party a bit late(initiating shorts below 3700--- though that might mean not trading a Gap Down of 3800-3500) or rather well equipped(by hedging with 4000 calls, even at high premiums) rather than arrive naked at a gathering(i.e. without the precious capital if 5200 is reached on the upside)

Contributed By SG

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home