- FII's

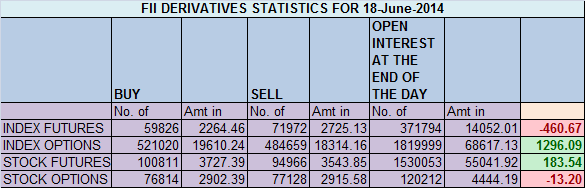

sold 12.1 K contract of Index Future worth 460 cores, 2.7 K Long

contract were added and 14.9 K short contracts were added So FII's went

aggressively short in index futures.My

observation is - Institutions short - Big Bears Short - Market Falls -

Big Bears Cover - Pigs Short -Institutions Cover - Market Rallies for

the Pigs to get slaughtered.

Nifty has

been sideways mode from past 10 trading session frustrating traders, On

06 June Nifty closed at 7583 and today it closed at 7540 so just a move

of 40 points from past 10 trading session on closing basis, Sentiments

in these 10 days went from Extreme Bullishness to Extreme Bearish with

nifty showing volatile moves within range of 7700-7480.As shown in

below chart, 7500-7520 range has been absorbing lot of selling pressure,

once if it gets broken we can see a quick downfall towards 7470-7450

range.Also Gann

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home