FII FnO Analysis for 11 April trade in Nifty Future

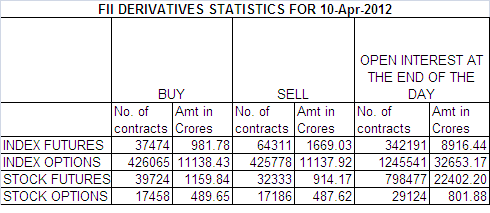

Below is my Interpretation of FII OI data Sheet for 10-Apr-12.

1. FII sold 26837 Contracts of NF worth 687 cores OI also increased by 2201.

2. As Nifty Futures was up by 13 points and OI has increased by 2201,now as they were net sellers of 26837 contracts with 6 days in April series they have net sold 68532 contracts. So we are seeing shorts entering into the system. Nifty Reacted sharply from the upper end of series ie.5382 and looking at last 6 days of data it prudent to assume they have shorted the index at higher levels.

3. Nifty closed below 20SMA@5296 and 50 SMA@5334 for today making it bearish in short term. Trend is favoring bears and Sell on rise should be mantra for the positional traders.

4.Trading range for NF is 5380-5221. It touched the upper end unable to sustain and bears pushed it to lower end Low today was 5245.So tomorrow we need to closely watch

Read the Full Story

1. FII sold 26837 Contracts of NF worth 687 cores OI also increased by 2201.

2. As Nifty Futures was up by 13 points and OI has increased by 2201,now as they were net sellers of 26837 contracts with 6 days in April series they have net sold 68532 contracts. So we are seeing shorts entering into the system. Nifty Reacted sharply from the upper end of series ie.5382 and looking at last 6 days of data it prudent to assume they have shorted the index at higher levels.

3. Nifty closed below 20SMA@5296 and 50 SMA@5334 for today making it bearish in short term. Trend is favoring bears and Sell on rise should be mantra for the positional traders.

4.Trading range for NF is 5380-5221. It touched the upper end unable to sustain and bears pushed it to lower end Low today was 5245.So tomorrow we need to closely watch

Read the Full Story

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home