FII Derivative Data Analysis for 17 July trade in Nifty Future

Inflation cooled to 7.25% which is welcome news for market as it raises the Hope for RBI to cut rates.From Macro perceptive Monsoon is current overhang for the market, any shortfall in rains can again see the food prices spiraling ahead and putting weight on inflation.

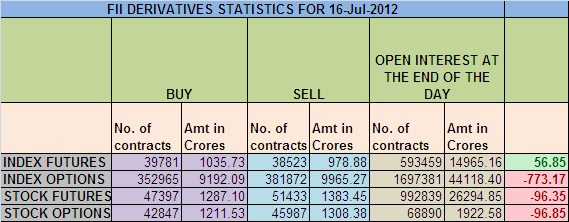

1. FII bought 1258 Contracts of NF ,worth 56.85 cores with net OI increasing by 3550 contracts.

2. As Nifty Future was down by 33 points and OI has increased by 3550 contracts means FII have covered partial shorts near 5204 NF. Also the Average price for NF comes at crazy number 9038 which suggests some longs were also carried over by FII

3. NS made a low of 5190 which is just 1 point short of 5189 which we have been discussing from many days,not breaking 5189 suggests bulls want to push market higher. We also took a..

Read the Full Story

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home