Nifty Trading Strategy before IIP Data and Infosys Earning

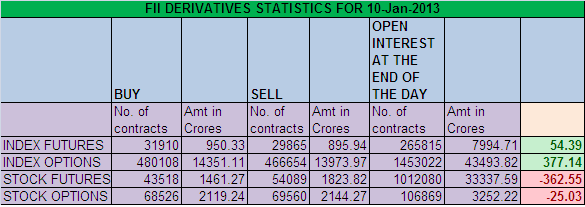

1. FIIs bought 2045 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 54.39 cores with net Open Interest increasing by 15325 contracts.Do you think we are in Bubble? Read this to get more insight How to survive stock market bubble http://bit.ly/XQgXOJ

2. As CNX Nifty Future was up by 4.8 points with Open Interest in Index Futures increasing by 15325, so FIIs booked out shorts in Nifty and Bank Nifty Futures. As the average Buy rate comes as an weird number of 5319 suggesting intraday trades taken by FII. Two important data coming out tommrow IIP data around 11 AM and Infosys results before market opens so tommrow expect some volatility in market.We have interesting Poll going on our FaceBook Page Bramesh tech (Click on Link) regarding Infosys opening. Please feel free to participate and post your views.

3. NS closed at 5968 after making high ...

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home