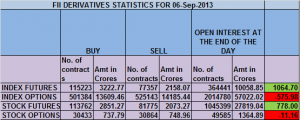

FII FnO data analysis for 10 Sep trade in NF and BNF.

- FIIs bought 37866 contracts of Index Future (Bought 24525 long contract and 13341 shorts were liquidated) worth 778 cores with net Open Interest increasing by 11184 contracts.So FII have covered 81K contract of NF and BNF shorts in past 3 trading sessions and added 25.6K contract of fresh longs in NF and BNF suggesting short covering done and now follow up buying await to push index higher.

- Nifty is approaching its crucial 50 DMA@5705 tomorrow, Any close above it will propel nifty further towards 200 DMA as discussed in weekly analysis.

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home