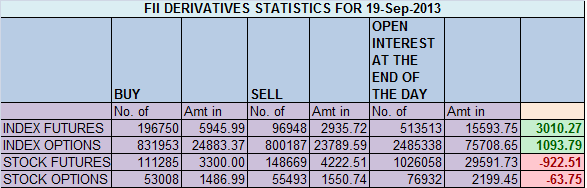

- FIIs bought 99802 contracts of Index Future (bought 80352 long contract and 19450 shorts were squared off) worth

3010 cores with net Open Interest increasing by 60902 contracts.So Fed

kept the money flowing to India and FII have again been a net Buyers in

Index Futures.

Nifty in past 6 days was trading and

consolidating above 200 DMA, and opened with big gap of 200 points, Many

were surprised by the move and ferocity of the move but readers of the

blog would have enjoyed the rally, We have discussed September is

Bullish month for Indian markets, In

Nifty Weekly Analysis clearly mentioned till it trades above..

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home