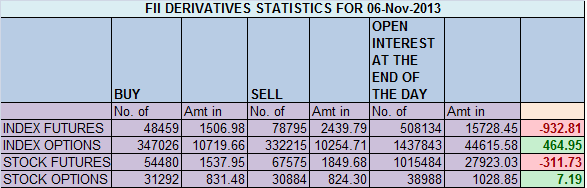

- FIIs sold 30336 contracts of Index Future (sold 16185 long contract and 14151 shorts were entered ) worth 933 cores with net Open Interest decreasing by 1726 contracts.Fall

has been not swift but slow and steady decline in Intraday, suggesting

traders are still bullish in market and using dips to Buy, but all

intraday rallies are getting sold into as FII are using rise to exit

longs and enter shorts.

Nifty continued

with its correction for 2 day running and broke the crucial support of

6230-6235 and closed below it,Nifty had retraced 50% of the current rise

from 6079

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home