Nifty corrects from Elliot wave target, FII Data analysis

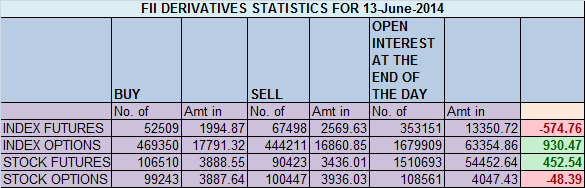

- FII's sold 14989 contract of Index Future worth 574 cores, 5348 Long contract were squared off and 9641 short contracts were added.Net Long Contract for FII's are just 21K for the current series which is lowest in 2014, so FII's are majorly going short in market.

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home