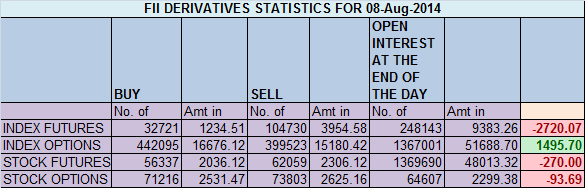

- FII's

sold 72009 contract of Index Future worth 2720 cores, 44.4 K Long

contract were squared off and 27.5 K short contracts were added by

FII's. Net Open Interest decreased by 16.9 K contract.FII's went into

panic mode today after a big gap down and squared off Huge Long Position

in Index Futures which were getting rollovered from March Series. This

Kind of single day selling was seen way back in 2010 so looks quiet

scary.The surprising thing is that NF range today was just 58 points and

we saw no major decline in Nifty after gap down suggesting FII's were

able to exit there long position without creating any major panic in

market.

Nifty closed below its 50 DMA, after big gap down today, Here is the interesting part

Last time NS broke its 50 SMA was on..

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home