Nifty near trendline support, Will it hold tommrow ?

- FII's

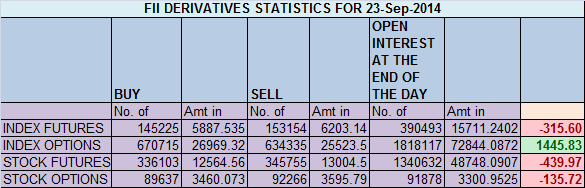

sold 7.9 K contract of Index Future worth 315 cores, 17.5 K Long

contract were added and 25.4 K short contracts were added by FII's. Net

Open Interest increased by 42.9 K contract , so FII added longs in

Index futures also shorts were added almost in 1:1.5 ratio.

This is what we discussed yesterday Bounce

seen today was because of Rollover pressure, Nifty again got resisted

near the Price Channel as shown in below chart also formed a double top

in daily chart, which need confirmation in next 2 days with price not

going above 8160 and breaking 8064.Break below 8064 can see a quick down

move towards 8015. Gann Turn date today so be cautious in trading

expect volatile moves today. Move was totally scripted as we..

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home