FII FnO Data Analysis for 26 Nov

- FII's

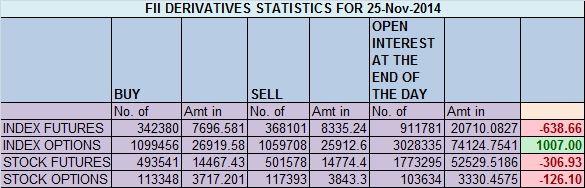

sold 25.7K contract of Index Future worth 638 cores, 4.7 K Long

contract were squared off by FII's and 20.9 K short contracts were

added by FII's. Net Open Interest decreased by 16.1 K contract , so

FII's added short in index futures and long in Index Futures.

As discussed yesterday

It

has been 24 days where Nifty has been rising and maximum correction

seen is 100 points, so till we are seeing correction of less than or

equal to 100 points buy all dips, Any pullback which extends 100 points

will only lead to correction. Today we saw a fall a decline for 106..

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home