- FII's

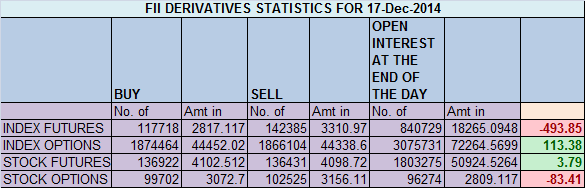

sold 24.6 K contract of Index Future worth 493 cores, 6.3 K Long

contract were liquidated by FII's and 18.2 K short contracts were added

by FII's. Net Open Interest increased by 11.9 K contract ,so FII's

liquidated long in Index Futures and continue adding shorts in index

future.

Nifty has corrected the scared 666 points in the current correction,

Review of Nifty Corrections in 2014

.Today fall has lead to capitulation as the last savior of Bulls

pharmas cracked today, market showed good recovery from the low of 7961

but till it do not close above 8082 bears are still having upper hand.

Nifty has taken support near the Gann Box, also signalling short term

bottom can be formed soon. Current market correction Bull market

correction are fast and furious so use the dips to enter delivery based

buying. As per quantitative analysis maximum rise seen in current fall

is 80-90 points so if we rise more than 90 points we can see..

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home