FII FnO Data Analysis for Nifty June Expiry

- FII's

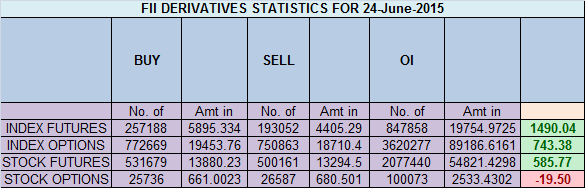

bought 64.1 K contract of Index Future worth 1490 cores ,113 K Long

contract were added off by FII's and 49 K short contracts were added

by FII's. Net Open Interest increased by 162 K contract, so todays

last hour expected fall was used by FII's to enter majority longs and

partial shorts in index futures. Do You Trade The Market or Your Emotions ?

This is what we discussed in yesterday analysis Nifty finally formed DOJI at

the upper end of AF as shown in below chart.So if 8393 not crossed which

is 50% Fibo retracement levels we can see some pullback of 8300/8270 in

nifty. Gunner also show we are heading to grey line and green arc so

caution advised on longs.High made today is at 3x1 gann angles as shown

in hourly charts. So Finally we had a pullback of

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home