Nifty near falling trendline resistance,FII FnO Data Analysis

- FII's

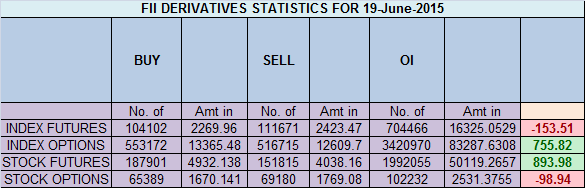

sold 7.5 K contract of Index Future worth 153 cores ,12.4 K Long

contract were squared off by FII's and 4.8 K short contracts were

squared off by FII's. Net Open Interest decreased by 17.3 K contract,

so todays rise was used by FII's to exit longs and shorts in index

futures. Important Pillars of Trading :Self Control and Discipline

This is what we have discussed in last few analysis We have been advocating the range of 7930-7950 being the demand zone for Nifty from 11 June Nifty made the following lows 7958,7940,7944 and 7946 also we have discussed in Weekly Analysis

from 14 June time cycle has changed to neutral to Bullish, market

obliged with 5 green close from past 5 days. Also Nifty has completed 2

crucial harmonic pattern ABCD and BAT pattern both are bullish if 7930

is held. Traders who bought should

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home