Nifty bounces from demand zone,FII FnO Data Analysis

- FII's

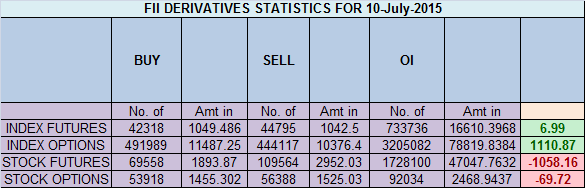

sold 2.4 K contract of Index Future worth 6 cores ,2 K Long

contract were added by FII's and 4.5 K short contracts were added by

FII's. Net Open Interest increased by 6.5 K contract, so today's fall

was used by FII's to enter shorts and longs in index futures What You Can Learn From Great Sportsmen to Improve Trading

As discussed in last analysis 8318-8300

range is very important demand zone as shown in below chart, holding

the same and moving above 8400 can see bulls coming back else we will

see a further fall towards 8223 odd area. Nifty made low of 8316 exactly near our demand zone of 8318

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home