Nifty technical set up before crucial Greece Referendum

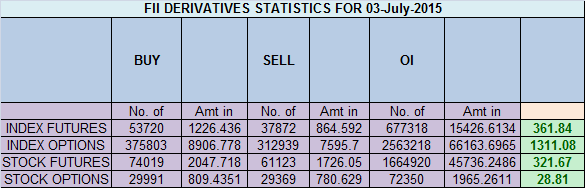

- FII's

bought 15.8 K contract of Index Future worth 361 cores ,16.4 K Long

contract were added by FII's and 0.05 K short contracts were added by

FII's. Net Open Interest increased by 16.9 K contract, so today's rise

was used by FII's to enter longs in index futures How Markets Will React to Greek Referendum

Nifty

made high of 8497 which is 61.8% retracement from 8845-7940 and also

closed above 100 DMA , Nifty also was unable to cross the pyrapoint

resistance at 0 degree line as shown in below chart, Weekly Closing was

above 20 WSMA. So Bulls and bears are hanging on balance as the result

of Greece referendum

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home