Nifty breaks 20 DMA, FII FnO Data Analysis

- FII's

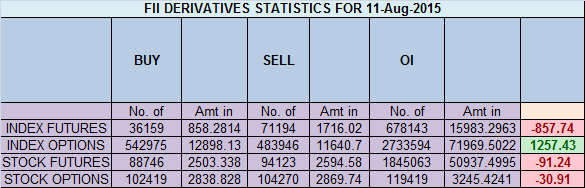

sold 35 K contract of Index Future worth 857 cores ,16.8 K Long

contract were squared off by FII's and 18.1K short contracts were

added by FII's. Net Open Interest decreased by 1.2 K contract, so

today's fall in market was used by FII's to exit long in index futures

and enter shorts .When You fail as a trader

Nifty formed lower low and lower high as it was unable to cross crucial supply area as discussed in Weekly analysis.This is what we discussed yesterday Gann

Box with hourly charts are also shown with support and resistance so

got resisted at 8x1 line and saw a quick fall till 3x1line, breaking

today low of 8497 will see Nifty moving towards 2x1 line @8454. Support now lies in range of 8375-8400 range, Gann Box break of

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home