Nifty bounces from demand zone, FII FnO Data Analysis

- FII's

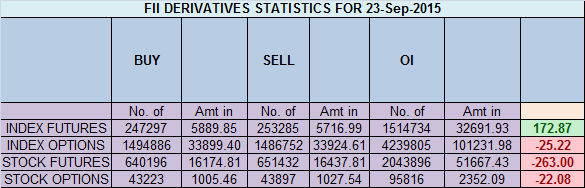

sold 35.9 K contract of Index Future worth 697 cores ,80.4 K Long

contract were added by FII's and 116 K short contracts were added of

by FII's. Net Open Interest increased by 196 K contract, so today's

fall in market was used by FII's to enter both long and huge shorts in

Index futures, as Rollover have started happening. Important Message for Traders Holding Dec 2015 Options Contracts

As discussed in previous analysis 7767 is the demand zone if held we can see bounceback till 7870/7900 if not we are heading towards 7539 and 7422 Nifty made low of..

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home