Nifty Technical Structure for October Expiry

- FII's

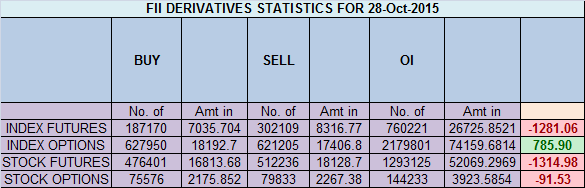

sold 114 K contract of Index Future worth 1281 cores ,125 K Long

contract were liquidated by FII's and 10.2 K short contracts were

liquidated by FII's. Net Open Interest decreased by 135 K contract, so

today's fall in market was used by FII's to exit long and exit

majority shorts in Index futures How to Build Confidence as a Trader

As discussed yesterday Nifty

high at 8336 was exactly at gann angle drawn from the high of 9119, we

have got sell off in past 2 occasion once nifty touched this angle as

shown in below gann chart. Today close was near support zone break below

it can see nifty going towards 8128/8150 range. Gann Analysis worked again as Nifty continues its correction, today was 3 days of correction, as

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home