Nifty forms double bottom,FII FnO Data Analysis

- FII's

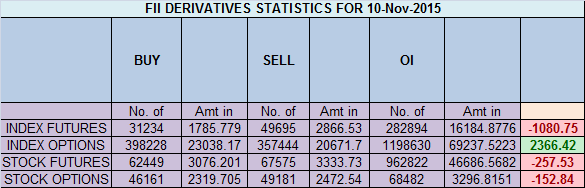

sold 18.4 K contract of Index Future worth 1080 cores ,12.2 K Long

contract were liquidated by FII's and 6.1 K short contracts were added

by FII's. Net Open Interest decreased by 6 K contract, so today's

fall in market was used by FII's to exit long and add shorts in Index

futures Muhurat Trading session: Vows Traders should make to avoid loss

As discussed in Weekly analysis ,

7783 as per SHARK harmonic pattern should be probable target of

downmove, 7767 was also the demand zone, 7771 was the low made on Monday

and 7772 low was made on Tuesday and nifty bounced

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home