Nifty took support at demand zone,EOD Analysis

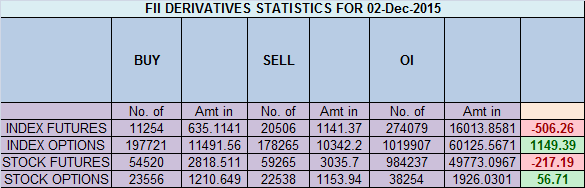

- FII's

sold 9.2 K contract of Index Future worth 506 cores ,4.6 K Long

contract were liquidated by FII's and 4.6 K short contracts were added

by FII's. Net Open Interest increased by 28 contract, so today's fall

in market was used by FII's to exit long and enter shorts in Index

futures. How Your Brain Gets In The Way of Your Trading Success

As discussed yesterday Nifty

is nearing trend change as shown in gann swing chart, Closing above

7994 will lead to trend change on upside, Till 7906 is held we can move

towards 7994/8051/8116, Support is at 7906/7851. Nifty made high of 7979 unable to cross 7994 and started the fall and made low of 7911 near our demand zone of 7906

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home