Nifty Bounces after 606 correction,EOD Analysis

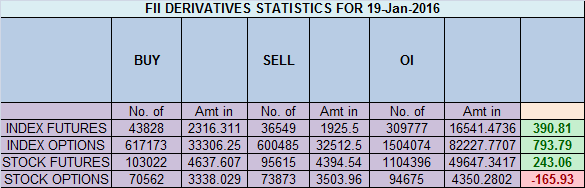

- FII's

bought 7.2 K contract of Index Future worth 391 cores ,2.2 K Long

contract were added by FII's and 4.9 K short contracts were liquidated

by FII's. Net Open Interest decreased by 2.6 K contract, so rise in

market was used by FII's to enter long and exit shorts in Index

futures.Keep losses small in order to avoid huge losses

As discussed in yesterday analysis Nifty

has formed a BULLISH ABCD pattern near so if 7323 is held we can see

bounceback till 7579/7610/7654 in short term , Short covering rally will

be fast and furious. Nifty has corrected 637 so short covering rally

cannot be ruled out, our levels are 7323/7300 should be held for the

rally to take place. Nifty started

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home