Nifty rallies once 7462 is broken,EOD Analysis

- FII's

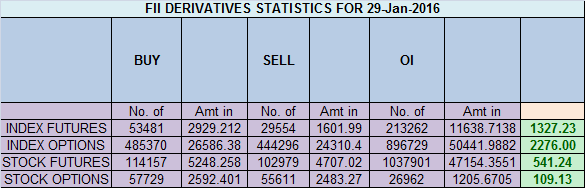

bought 23.9 K contract of Index Future worth 1327 cores ,20.4 K Long

contract were added by FII's and 3.4 K short contracts were liquidated

by FII's. Net Open Interest increased by 17 K contract, so rise in

market was used by FII's to enter long and exit shorts in Index

futures. Every Success Story Is Also A Story Of Great Failure

As discussed in Last Analysis We need a close above 7462 for market to reach the next target of ABCD pattern @ 7521. Now

range of 7460-7480 should be watched closely as closing above it can

see nifty moving in 7550-7575 range where we have strong supply, Nifty opened near gann arc as shown below and started recovering and once move above 7462 rallied

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home