Nifty close below 7230 to invalidate harmonic patterns,EOD Analysis

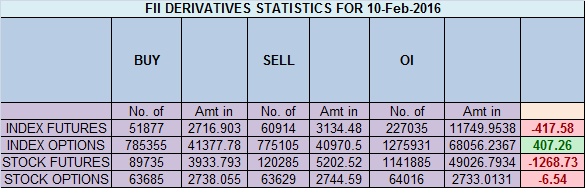

- FII's

sold 9 K contract of Index Future worth 417 cores ,65 Long

contract were added by FII's and 9 K short contracts were added by

FII's. Net Open Interest increased by 9.1 K contract, so fall in market

was used by FII's to enter small qty long and enter good amount of

shorts in Index futures. Bad Trading Habits and How to Avoid Them

As discussed in Last Analysis Nifty

closed below 7300 and made low of 7275 to full fill BAT pattern

condition now if we do not break 7230 we might rally to form the final

leg of BAT pattern, any close below 7230 invalidates the pattern. Also a

small ABCD pattern can be seen which gets completed in range of

7257-7230 so again 7230 needs to be watched for next 2 days to see if

patterns are failed or

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home