Nifty Bounces from gann arc with Hammer Candle,EOD Analysis

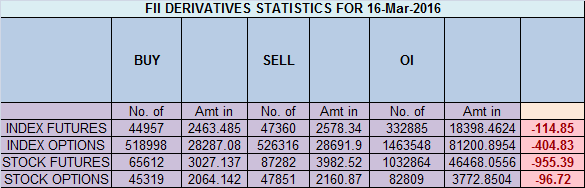

- FII's

sold 2.4 K contract of Index Future worth 114 cores ,10.9 K Long

contract were added by FII's and 13.3 K short contracts were added by

FII's. Net Open Interest increased by 24.3 K contract, so fall in Nifty

market was used by FII's to enter long and exit shorts in Index

futures. How "Not learning" from Trading Mistakes can be Disastrous

As discussed in Last Analysis Nifty

finally has a correction of more than 100 points, its a slow and steady

fall we are seeing from past 2 session, as Nifty was unable to move

above the gann trendline as shown in below chart, Bulls need close

above 7554 for a move towards 7634. Bears below 7400 for move towards

7350/7228 else it will be sideways move in small range. Nifty made low

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home