Nifty gets resisted at gann arc, EOD Analysis

- FII's

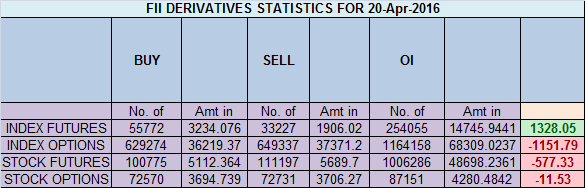

bought 22.5 K contract of Index Future worth 1328 cores ,17.4 K Long

contract were added by FII's and 5.1 K short contracts were liquidated

by FII's. Net Open Interest increased by 12.3 K contract, so rise in

Nifty market was used by FII's to enter long and exit shorts in Index

futures.Why Retail Traders lose money in Stock market

As discussed in last analysis Now if we close above 7950/7972 range can see quick move towards 8100. Bearish only on close below 7850. High made today

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home