Nifty trading near gann arc,EOD Analysis

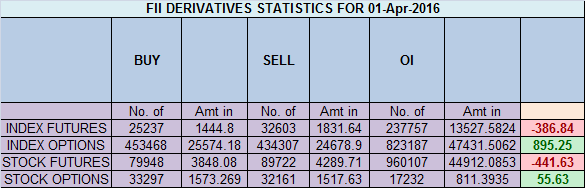

- FII's

sold 7.3 K contract of Index Future worth 386 cores ,4.1 K Long

contract were liquidated by FII's and 3.1 K short contracts were added

by FII's. Net Open Interest decreased by 0.9 K contract, so fall in

Nifty market was used by FII's to exit long and enter shorts in Index

futures.Which type of a trader are you?

Nifty

after turning from the butterfly PRZ zone and also made high near the

gann arc, suggesting resistance will be strong as its confluence of

different studies is happening,

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home