Nifty Bounces but unable to sustain Higher,EOD Analysis

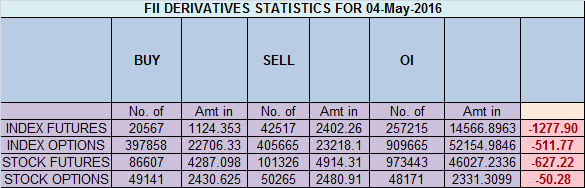

- FII's

sold 21.9 K contract of Index Future worth 1277 cores ,19.7 K Long

contract were liquidated by FII's and 2.2 K short contracts were added

by FII's. Net Open Interest decreased by 17.5 K contract, so fall in

market was used by FII's to exit long and enter shorts in Index

futures. How not to Increase Your Trading Losses

As discussed in last analysis Nifty

made low of 7697 does the target of 7700 near gann support line as

shown in below chart, If we hold this line we can see bounce back till

7800/7850 range. Unable to close above 7850 in bounce back we can fall

all the way till 7546-7501 in next 2-3 weeks, High made

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home