Nifty Bulls held on to 7777, EOD Analysis

- FII's

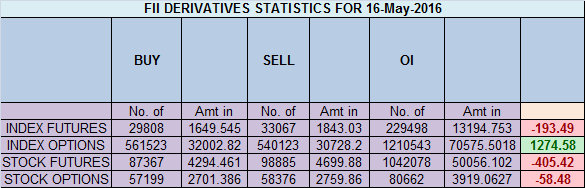

sold 3.2 K contract of Index Future worth 193 cores ,2.2 K Long

contract were liquidated by FII's and 1 K short contracts were added by

FII's. Net Open Interest decreased by 1.1 K contract, so rise in market

was used by FII's to exit long and shorts were added in Index

futures.Cella Quinn from Dishwasher to President of Investment Firm

As discussed in last analysis

Low made today was 7784, highlighting the importance of 7777 and closed

above 7800 but below 7850, so market closed at no trade zone, Also we

are near the gann trendline as shown below, holding the same we can see

bounce back. Nifty again

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home