Nifty continue to trade in small range,EOD Analysis

- FII's

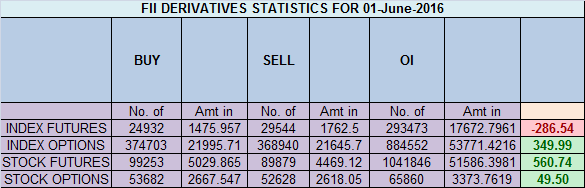

sold 4.6 K contract of Index Future worth 286 cores ,149 Long

contract were added by FII's and 4.7 K short contracts were liquidated

by FII's. Net Open Interest increased by 4.9 K contract, so fall in

market was used by FII's to enter long and enter shorts in Index

futures.How to improve on trading results What is the main Reason for Your Trading Loss, We are running POLL on Twitter Please participate

As discussed in Yesterday Analysis 8210-8241

is crucial as its a supply zone and also PRZ zone of ABCD pattern,

Unable to close above it we can see down move till 8075/8100.

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home