Nifty June Expiry Analysis

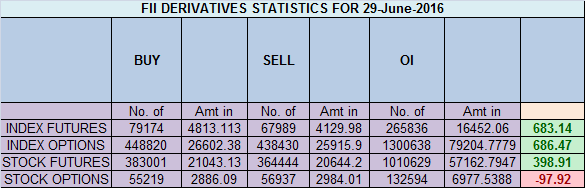

- FII's

bought 11.1 K contract of Index Future worth 683 cores ,12.8 K Long

contract were added by FII's and 1.6 K short contracts were added by

FII's. Net Open Interest increased by 14.4 K contract, so rise in

market was used by FII's to enter long and enter shorts in Index

futures.Why I fail as a trader

As discussed in Yesterday Analysis For

next 4 days 8111 will play a important role on upside and 7972 on

downside, breaking any one of the levels can see move 8210/8241 on

upside and 7921/7777 on downside. High made today was 8212. Panic was created with gap down and whole move have been retraced but its not a faster retracement,

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home