Nifty use Brexit event to bounce from demand zone, EOD Analysis

- FII's

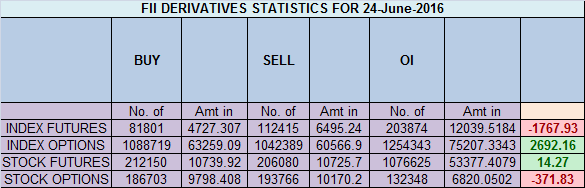

sold 30.6 K contract of Index Future worth 1767 cores ,30.9 K Long

contract were liquidated by FII's and 327 short contracts were

liquidated by FII's. Net Open Interest increased by 31.2 K contract,

so fall in market was used by FII's to exit long and exit shorts in

Index futures.Its all about Will power, Amazing Story of Girish Gogia

As discussed in Yesterday Analysis Nifty did close above 8210 suggesting a bullish set up but the overnight news event on Brexit did a gap down of almost 250 points.

As i always suggest if you are trader with small capital do not take

aggressive position before the event, and if you take you should be

properly hedged, Its just like Term Insurance which will make sure you

do not suffer a big blow in your trading account. Always remember trading is all about Risk Management, Manage Risk Profits will follow.

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home