Nifty close to complete its time correction, EOD Analysis

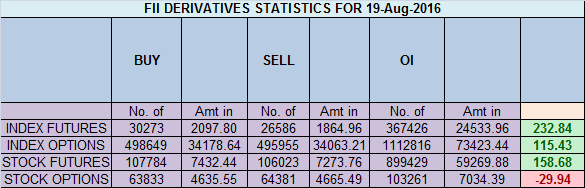

- FII's

bought 3.6 K contract of Index Future worth 232 cores ,5.7 K Long

contract were added by FII's and 2 K short contracts were added by

FII's. Net Open Interest increased by 7.8 K contract, so fall in market

was used by FII's to enter long and enter shorts in Index futures. Trading Psychology : Walking The Plank

As discussed in Yesterday Analysis Now

Bulls need to close above the range of 8711 for next move towards

8779-8800-8851. Bears will get active on close below 8484 only.

Its been 20 days we have traded in range of 204 points 8517-8721,

suggesting market is seeing time correction frustrating traders and

hitting SL, traders who survive this phase by applying risk and money

management are rewarded handsomely in the next move . High made today

was 8696 so bulls need to wait for break of

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home