trading in nifty futures

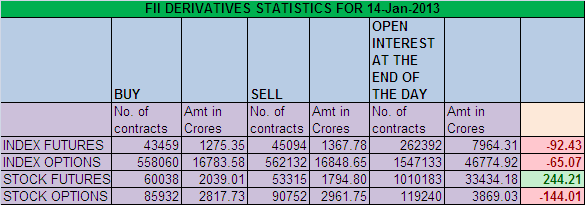

1. FIIs sold 1635 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 92.43 cores with net Open Interest decreasing by 207 contracts.

2. As CNX Nifty Future was up by 80 points highest in the Jan Series with Open Interest in Index Futures decreasing by 207, so FIIs booked out longs in Nifty and Bank Nifty Futures. As the average Buy rate comes as an weird number of 11306 suggesting intraday trades taken by FII. Basically the rally was backed by short covering and Inflation data and GAAR news were added booster for the Nifty.

3. NS closed at 6024 after making high ..

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home