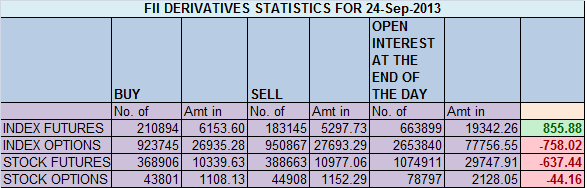

- FIIs bought 27749 contracts of Index Future (bought 45251 long contract and 17502 shorts were added) worth 856 cores with net Open Interest increasing by 62753 contracts. SO FII's went aggressively long today.

Nifty

opened below the upward rising trendline and near its 200 DMA, and

closed near to the trendline confusing both Bulls and Bears.Bulls will

try to protect the 200 DMA and bears will get upper hand as soon as

Nifty start trading below the Chopad levels of 5806.

Price Action Strategy has ..

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home