S&P 500 10% Correction Could Be 5 Years Away

This is an Interesting information for all the Die Hard Bulls and Bears. Looking at Fed Yellen Testament yesterday it seems to be true.

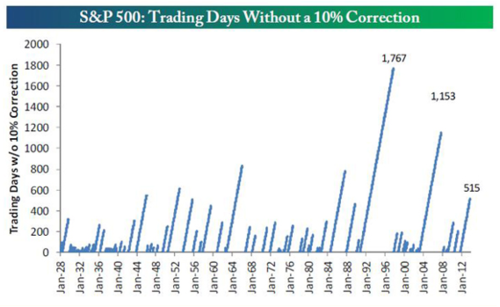

There has been a lot of concern that US stocks have gone too far lately without a 10% correction. The fear is that, if the market goes on too long without losing at least a tenth of its value off a high, any pullbacks to come in the future will be a lot more dramatic.

The analysts over at Bespoke Investment Group took a look at that question this week and came up with an interesting study. They observed that the S&P 500 has now rallied 59% over a period of 515 trading days since Oct. 3, 2011, without logging a 10% decline from a high. And while it is certainly unusual, it is by no means unprecedented, or even close to the longest such streak.

Continue Reading

There has been a lot of concern that US stocks have gone too far lately without a 10% correction. The fear is that, if the market goes on too long without losing at least a tenth of its value off a high, any pullbacks to come in the future will be a lot more dramatic.

The analysts over at Bespoke Investment Group took a look at that question this week and came up with an interesting study. They observed that the S&P 500 has now rallied 59% over a period of 515 trading days since Oct. 3, 2011, without logging a 10% decline from a high. And while it is certainly unusual, it is by no means unprecedented, or even close to the longest such streak.

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home