- FII's

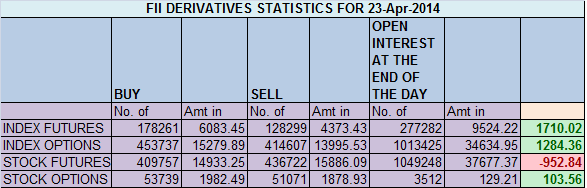

bought 49962 contract of Index Futures worth 1710 cores with net OI

decreasing by 2 lakh contracts. So on expiry day FII's squared off most

of shorts they were carrying as rollover in the Nifty at around 59% is

lower than the three-month average of 65%, indicating FII's sees the

risk of taking bullish or bearish bets is far too high ahead of the

election outcome on May 16.

As discussed in last analysis in Elliot wave chart of NS

Nifty made an exact high of 6861. Now for Friday Range of 6895-6909 is

crucial range as per Elliot wave, Crossing and sustaining the same

nifty can

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home