Nifty closes above 7000, How FII's are building position

- FII's sold 7265 contract of Index Futures worth 258 cores (4.8 K longs were squared off and 2.3 K shorts were added in Index Future) with net OI decreasing by 2.4 K contracts.FII's were square off more today.

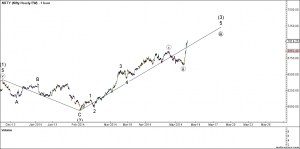

- This is what we discussed in past analysis As per classic TA Bulls market take support at 50% or 61.8% which in our case is 6587 for bounceback. To

test of Bull market will be seen in next 2 trading session. As per EW

if 6580-6618 is strong support zone holding the same we can see

7000-7200 levels. Nifty made a history today by closing above

7000, Tomorrow looking at exit poll reaction SGX trading at 6174

suggesting gap of 150-200 points on cards, Near 7220-7250 range traders

should book some profit.

Time taken by Nifty to cross

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home