Nifty forms panic low, How to trade Expiry day

- FII's

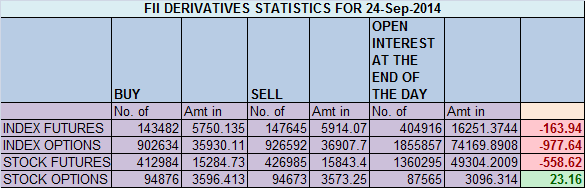

sold 4.1 K contract of Index Future worth 164 cores, 5.1 K Long

contract were added and 9.2 K short contracts were added by FII's. Net

Open Interest increased by14.4 K contract , so FII added longs in

Index futures also shorts were added almost in 1:1.8 ratio.

This is what we discussed yesterday we are nearing trendline support, we can see intraday break of trendline till 7963/7930 but might close above this.

So we did a panic low of 7950 on coal block case and bounced back

sharply to close above 8000. As per EW we can now move to 8072 odd

levels. Nifty held on to its trendline and today we can see a follow

upmove. Nifty is trading in sideways mode of 7950-8160 and this

rangebound trading can go on till bias change from neutral to bullish as

discussed in weekly analysis. Bias is new concept we are developing to understand the future ...

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home