Nifty Breaks gann trendline,EOD Analysis

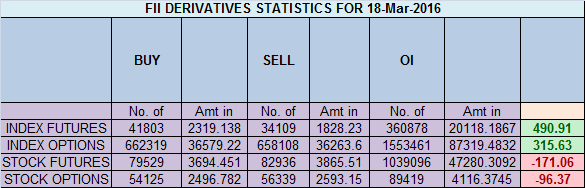

- FII's

bought 7.6 K contract of Index Future worth 490 cores ,16.1 K Long

contract were added by FII's and 8.4 K short contracts were added by

FII's. Net Open Interest increased by 24.5 K contract, so rise in Nifty

market was used by FII's to enter long and enter shorts in Index

futures.How To Get What I Want

As discussed in Last Analysis Nifty

opened with gap up made high of 7585 and again unable to close above

both gann trendline and demand zone of 7554, but again was able to held

on to gann arc, suggesting bulls are in control. Nifty gann arc again helped us

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home