Nifty fails to close above 8336,EOD Analysis

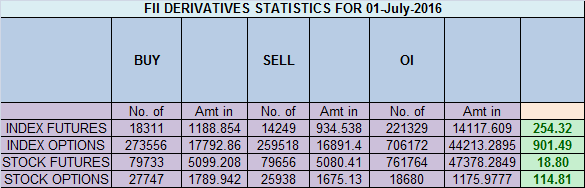

- FII's

bought 4 K contract of Index Future worth 254 cores ,5.2 K Long

contract were added by FII's and 1.1 K short contracts were added by

FII's. Net Open Interest increased by 6.3 K contract, so rise in

market was used by FII's to enter long and enter shorts in Index

futures.Detrended Price Oscillator (DPO) Introduction

As discussed in Yesterday Analysis Breakout only on close of 8336 for target of 8545/8700. Bears will get active only on close below 8100.High made today was 8356 but again closed below 8336 suggesting the importance of 8336.

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home