Nifty fails to close above 8372 and 8336,EOD Analysis

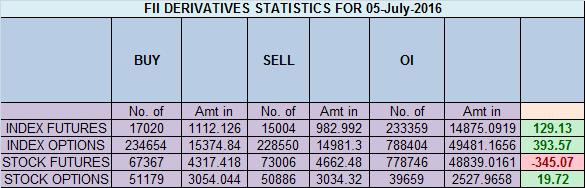

- FII's bought 2 K contract of Index Future worth 129 cores ,2.6K Long contract were added by FII's and 0.06 K short contracts were added by FII's. Net Open Interest increased by 3.2 K contract, so fall in market was used by FII's to enter long and enter shorts in Index futures. How Long Does It Take To Learn How To Trade?

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home