- FII's

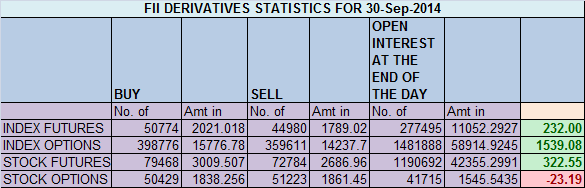

bought 5.7 K contract of Index Future worth 232 cores, 8.5 K Long

contract were added and 2.7 K short contracts were added by FII's. Net

Open Interest increased by 11.2 K contract , so FII added both long

and short in index futures.

Nifty has as expected

volatile day , but as per Gann Box it continued trading in Yellow and

Green line suggesting range bound volatile move. 7921/7911 have become

an important demand zone and on upside 8030/8060 range have become the

supply zone, closing above or below this range can quickly give a move

on 100+ point. We have 3 trading holidays so try to avoid ...

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home