Will Nifty Bulls invalidate the ABCD pattern,EOD Analysis

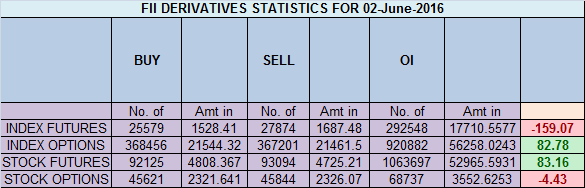

- FII's

sold 2.2 K contract of Index Future worth 159 cores ,1.6 K Long

contract were liquidated by FII's and 0.06 K short contracts were added

by FII's. Net Open Interest decreased by 0.09 K contract, so rise in

market was used by FII's to exit long and enter shorts in Index

futures.Mindset Shifts for successful trading

As discussed in Yesterday Analysis 8210-8241

is crucial as its a supply zone and also PRZ zone of ABCD pattern,

Unable to close above it we can see down move till 8075/8100. High

made today was 8229, Bulls needs a close above 8210-8241 range for next

move towards 8336/8400 else correction till 8075/8000. ABCD pattern

will get invalidated on close above 8242. Weekly closing

Continue Reading

0 Comments:

Post a Comment

Note: Only a member of this blog may post a comment.

Subscribe to Post Comments [Atom]

<< Home