Reliance Industries – Reasons for the fall

If one may recall, Mukesh Ambani, promoter of RIL had subscribed to 12 crores warrants of the company, to be converted into equal number of shares, at Rs.1,402 per share and total investment was Rs.16,824 crores. When we have seen many promoters not going in for warrant conversion or warrant subscription, this move had imbibed confidence into the market, when the same were converted, in the first week of October 08. Remember, Hindalco Industries promoters have allowed their warrant to get lapsed and have foregone Rs.130 crores paid by them at the time of warrant subscription, which were on 11th April 07, one day ahead of RIL warrant subscription by the promoters, viz. 12th April 07.

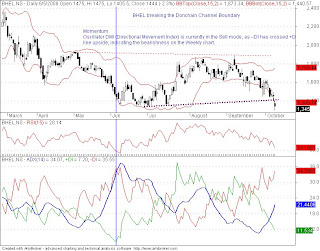

RIL share today though opened at Rs.1,465 against it previous day’s close to Rs.1,519, but fell to a low of Rs.1,327 and about 18 lakh shares were traded on BSE till 1 pm at an average rate of Rs.1,373 per share and while about 57 lakh shares on NSE at Rs.1,371 per share. This kind of fall in share price can happen only with delivery based selling, which may have been pressed by the institutional investors.

The stake of domestic mutual funds and insurance companies, in the company as at 30-09-08, is to the extent of about 9% with about 13 crores shares held by them. FIIs have been holding about 17% stake of the company, being 24.67 crore shares on that date, with 1,091 holders. Value of the investment at Rs.1,400 per share works out to Rs.34,000 crores being US $ 7 billion, of FII investors.

In view of FII selling of close to US $ 10 billion till date, in calendar year 2008, in the Indian market, it is feared that selling in RIL stock has been made by these FIIs only, on opening of the market. The same would get confirmed with FII datas to be released by the regulator in the next couple of days.

It is said that FIIs call to press sell button in the stock has nothing to do with the fundamental of the company but compulsion for them to mobilize liquidity at their end, by divesting stake in the frontliners. Due to this reason, we have seen a fall of about 11% in share price of TCS, as FII stake in TCS, as at 30-09-08, has been high at about 11%.

RIL share price was ruling at around Rs.1,400 per share in April 07, when the promoters have gone for warrant subscription, at an effective price of Rs.1,402 per share. RIL share had its 52 week high of Rs.3,252 per share, touched on 15-01-08 with low of Rs.1,327 having touched today. With RIL share price having moved past 3 K in January 08, everyone had praised the move of the promoters, as warrant subscription have made them richer by over Rs20,000 crores. At that time, it was found this to be a visionary move by the promoters as huge jump in the financial performance of RIL was expected, due to commencement of gas production by the company in KG D-6 block as also its subsidiary Reliance Petroleum, starting commercial production of its refinery at Jamnagar, way ahead of its scheduled date of December 08.

Now, the market is attributing reason for divesting the stake by FIIs due to concern on margins and profitability by RIL in the coming quarters. Expectations of fall in GRM due to softening crude prices as also steep fall in global petrochemical demand are seen as two main reasons. Though RIL has been able to maintain its volume and margin growth in Petchem segment, the same looks doubtful in the coming quarters. Even GRM, which has been ruling above $15 per barrel is likely to fall to $12 per barrel in Q2 and may head to touch in single digit by the end of 4th quarter of FY 09.

RIL for FY 08, had posted an EPS of Rs.105, before extraordinary items and mainly from its core business. EPS for June 08 quarter was placed at Rs.28.30 and it was expected that the same is likely to be about Rs.115,in FY 09, from its existing business thus giving a growth of slightly lower than 10% over FY 08. But now the same expectations may not hold true in view of concern stated above. Also it is expected that no significant contribution in FY 09 would come from RPL Refinery or KG Basin Gas Production. Both the projects would contribute in FY 10 only, may be for entire 12 months.

However, the contribution from both the new projects, in FY 10, though are difficult to assess now, but one can expect RIL to post an EPS of close to Rs.200 for FY 10. If we go by the same estimates the share is now ruling at a PE multiple of less than 7. Does this valuation makes the stock expensive?

In the scenario, we don’t think that fundamentals have any role to play when liquidity and sentiments are the dominating factors.