Nifty Future Trading levels for 1 Feb

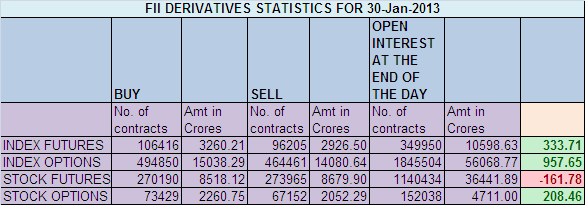

1. FIIs sold 16409 Contracts of Index Future (NSE Nifty Futures and Bank Nifty Futures combined),worth 458 cores with net Open Interest decreasing by 113531 contracts. Importance of Effective Trading Plan in trading profitably

2. As CNX Nifty Future was down by 25 points with Open Interest in Index Futures decreasing by 113531, there is nothing major to read in this as Last day of expiry FII do settle there positions we will get the clear picture from tomorrow's data.

3. NS closed at 6035 after making high of 6058 and low of 6025.As we have discussed yesterday we has a quiet expiry and in our expiry range of 6101-6010. Another Expiry with Nifty moving sideways but...

Continue Reading