Saturday, February 28

Thursday, February 26

Tuesday, February 24

Gold : 12 reason to short gold

Or at least spare me your hate mail. Because no matter what I say

today, I know you’ll cry foul… or something much more colorful.

But for those of you with an open mind - especially after my last

three contrarian predictions proved dead accurate, read on.

Because it’s time to start shorting gold!

You won’t find many, if anyone else, making this case. But as the

first reason of 12 below reveals, that’s precisely why you should give

it more credence.

12 Reasons To Start Shorting Gold

It’s decidedly contrarian. If a contrarian investor is someone who

deliberately decides to go against the prevailing wisdom of other

investors, shorting gold certainly fits the bill. Right now, everyone

else is buying gold, or at least recommending it. If you have any

doubt we’ve reached such fever pitch levels, consider No. 2.

The infomercial factor. The best indicator of a turning point for any

investment, in my experience, is infomercials. If an investment gets

so popular it invades the pre-dawn hours with non-stop but-wait-

there’s-more offers, it’s time to get out. And that’s exactly what’s

happening now. So much so companies like Cash4Gold.com are invading

primetime television. They even splurged for a Super Bowl ad spot. And

they recruited washed-up celebrities Ed McMahon and M.C. Hammer to

boot. In case you forgot, the Hammer filed bankruptcy in 1996. And

Eddie boy almost lost his 7,000 square-foot, $6.5 million Beverly

Hills pad to foreclosure. No offense, if you take investment cues from

these two, you deserve to lose money.

There is always some truth in a rumor. Recent news reports suggested

Germany, the world’s second-largest holder of gold, was selling some

from its vaults to trim its deficit. It turned out to be a rumor. But

you gotta wonder if there’s some truth behind it. After all, high gold

prices would be an easy way to raise cash. In other words, the

scenario is completely plausible. And if Germany’s considering it,

even remotely, so, too, are plenty of other deficit-ridden

governments. It goes without saying that a government dumping supply

on the market will send prices lower, quickly.

The gold-to-oil ratio is out of whack. Historically, an ounce of gold

will buy you about 14 barrels of oil. But with oil around $40 per

barrel, an ounce of gold gets you almost 23 barrels - a whopping 64%

above the historical mean. If you believe in statistics, a reversion

to the mean is imminent!

So is the gold-to-silver ratio. Historically, an ounce of gold will

buy you 31 ounces of silver. But now the ratio stands at 73 - an

unbelievable 134% above the historical mean. Here, too, a reversion to

the mean is imminent. And I’d rather place my bets on a 57% decrease

in the price of gold, than silver more than doubling to make it

happen.

The HGNSI index is too high at 60.9%. For the past 25 years, Hulbert

Financial Digest has tracked the average recommended gold market

exposure among a subset of gold-timing newsletters. It usually fleshes

out around 32.6%. But now it rests at 60.9%, a level it’s only

exceeded 13% of the time. The key - Hulbert found an inverse

correlation exists between his proprietary index and the short-term

market direction of gold. In other words, if the index is high, like

now, gold is headed lower.

Trinkets drive demand, not governments or speculators. Nearly 75% of

gold demand comes from the jewelry market. And if Indian brides balk

at buying above $750 per ounce as the Bombay Bullion Association

reports - India’s gold imports cratered 81% in December - look out

below. And don’t be fooled into thinking investors (governments or

speculators) will pick up the slack. As HSBC reports, rising demand

from investors, particularly from ETFs, only offset half of the 33%

decline in jewelry market demand since 2001.

What makes now “different?” If the global economic crisis keeps

getting worse, as goldbugs like to point out, why hasn’t gold tested

last March’s high of $1,030.80 per ounce? Or blown right by it? After

all, gold is supposed to increase in value as economic conditions

worsen. But it hasn’t lived up to expectations, not one bit. And I

don’t think it ever will. Ultimately, when you factor in the massive

amounts of stimulus being injected into the markets, on a global

level, we’re close to the worst of times… and the peak for gold.

Analysts love it. According to Bloomberg, 16 of 24 analysts surveyed

by the London Bullion Market Association believe gold will reach a

minimum of $1,032 per ounce this year. As we all know, analysts’ track

records are deplorable. Instead of just ignoring them, why not bet

against them? The odds are definitely in our favor.

Hedge fund buying dried up. Institutional speculators (hedge funds)

played a large part in gold’s run-up. But 920 of them went Kaplooey

last year, according to Hedge Fund Research, Inc. Not to mention,

hundreds of others hemorrhaged capital as investors demanded their

money back, while those left standing ratcheted down borrowing to

close to nothing, according to Rasini & C., a London-based investment

adviser. In the end, gold prices will eventually reflect the absence

of these former heavyweights.

Gold is schizophrenic and the wrong personality is in control.

Multiple motivations exist to buy gold including the desire for a safe

haven, currency, adornment, raw material, or inflation hedge. But much

like Treasuries, the bulk of buyers come from the safe haven camp

today. And once the economy shows any signs of perking up, we can

expect these same investors to flee for more risky assets. And don’t

be so quick to rule out a second half recovery…

The Fed, the President, history and the Baltic Dry Index concur - the

economy’s on the mend. Despite dismal data, both the Fed and President

Obama point to the current recession ending by the second half of

2009. Moreover, the average recession only lasts 14.4 months. So even

if this one is longer than usual, we’re still near the tail end of it.

A fact underscored by the recent 61.4% rally in the Baltic Dry Index

from its early December low. As I wrote in November 2008, the index is

the first pure indicator of an uptick in global activity. And once the

economy gets back into gear, the Fed will act quickly to reign in the

money supply and curb inflation.

Cleary the gold rush is on. But that’s all the more reason to move in

the opposite direction, against the herd. I realize this might be the

most unpopular recommendation right now, but that means it could also

be the most profitable.

And before you brandish me a fool for recommending shorting Treasuries

and gold in the span of two months, here’s the intersection. The

driving force behind both assets in recent months has been safe haven

buying. And it will remain the dominant variable in determining price

in the months ahead. So when investors go back on the attack for more

risky assets, prices for both assets will fall.

It’s already happening for Treasuries. And I’m convinced gold is next.

Good (and contrarian) investing,

by Louis Basenese, Advisory Panelist

Senior Analyst, The Oxford Club

Monday, February 23

Weekly NIfty Levels and Stock Trading Ideas

First of all i would thanks AR for Slum dog Millionaire Fame and the first India to win 2 oscars

Now on markets Nifty is week Below 2660 as shown in charts below and in this exipry week i see nifty in the range from 2720-2860.All asin and Europe are in green on hope that Citi will get capital aid.

Nifty Levels for tomorrow 2700 lies the support Resistance at 2755 -2780-2825

Stocks specific

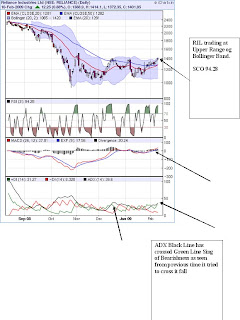

Poster Boy Reliance support at 1235 and 1217 and resistance at 1277 and 1300

Rel capital Rel infra all can see short covering of 5-7%

SBN position can be taken with a sl of 980 at 1033 -1023 with a tgt of 1050 1066 and 1100

United Spirits positions can be taken at 550 whereas resistnce exsits at 586 and 605

Option call we have taken 2 lots of 2800 CE at 12 on friday and now will trade only in march series

Tuesday, February 17

NIfty Breaking Trainngle Formation and Channel is Broken

Nifty has broken out of ascending Triangle Range Now Support comes at 2733 2696 so get ready for another Volatile session tomorrow

SCO is at 10 so keep booking ur shorts and wait for confirmation to buy Longs

If 2720 Breaks Fall is accelerated

2600 Puts up 300% more to come

RIL has support at 1248 1228 and 1200 below that 1175 and than new low is waiting

GOLD - THE SHINE GETS BRIGHTER

The markets are down, which is not so good. Oil prices are down which is good. The rupee vis-s-vis the US dollar is better which is also good. Inflation is down, which is excellent. Economic growth is down, which cannot be helped. But gold is scaling new highs everyday, now that is a real shocker!

Gold futures hit a new high of Rs 15,050 per 10 gram in early deals today, taking cues from the firm trend in other Asian markets, where it shot up by 1.55% to $956.20 an ounce, which is the highest in seven months. On the Multi Commodity Exchange, gold for August-month contract shot up by 2.31 per cent to Rs 15,050 per 10 gram. The contract clocked business turnover of five lots.

The interim Budget might have been a damp squib and pulled down the other indices but for gold, there seems to be no stopping. So why is everyone around the world buying gold? Indians buying gold is routine but all over the world people buying like there is no tomorrow is new. World recession and uncertainty are the two main reasons. After the collapse of some of the biggest banks in the world, people just do not trust even the banks. The feeling is that they need to park funds in something which would not just vanish into thin air. Holding cash is risky as currency value also depreciates. Realty was usually the other avenue where people parked their funds but today, even that is not an option. And there is also no certainty about when the recession gripping the world would come to an end. More and more people, are thus shifting to gold.

With so much money also being printed in

Apart from investors flocking to buy gold, the marriage season is on in the largest market of gold in the world,

Protecting the value of their money is the single most priority and that is something which only gold seems to offer. This can be gauged from the fact that the world's top five gold exchange traded funds (ETFs) have increased their gold reserves by 108 tonne in the past three months. The total holding of these five five ETFs has gone up to 1,080 tonne from 972 tonne.

Apart from coins, biscuits and jewellery, the investors are exploring the option of ETFs. A gold ETF is a financial instrument like a mutual fund whose value depends on the price of gold. In most cases, the price of one unit of a gold ETF reflects the price of approximately 1 gram of gold. As the price of gold rises, that of the ETF is also expected to rise equally. Most gold ETFs are traded on the National Stock Exchange, so one requires a broker who is its member. There are five gold ETFs in the market at present — Gold BeEs, Kotak Gold, Quantum Gold, Reliance Gold and UTI Gold ETF.

Compiled from SP Tulsian.com

Sunday, February 15

Thursday, February 12

GOLD and CRUDE Charts

West Texas Crude is testing the band of support between $33 and $35/barrel. A close below $35 or intra-day break below $33 would warn of a down-swing to test the 2003 low of $20. The target is calculated as 35 - (50 - 35).

Spot gold broke through resistance at $930, indicating another test of $1000. Retracement that respects the new support level would strengthen the signal. Reversal below the recent low at $890 is less likely, but would warn of another test of $700. In the longer term, breakout above $1000 would offer a target of $1200; calculated as 900 + ( 1000 - 700 ).

Tuesday, February 10

Reliance Industries Technical Picture

Reliance Bears are again getting an upperhand Entering in its resistance zone of 1400-1425 today also unable to cross

MACD and Bollinger Band are in upper end of range

Stocks should show a Breather and still in a range of 1240-1425 either one should break on lower side

Can be shorted with 1425 as Sl and long can be intiated only above 1430

Monday, February 9

Indication from Twigg's Money Flow Indicator

The Sensex continues to test resistance at 9500, influenced by positive sentiment in the US. Breakout would offer a target of 10500, while respect would test primary support at 8500. Twiggs Money Flow (21-Day) reversal above zero would signal buying pressure. In the long term, the primary trend is down and reversal below 8500 would offer a target of the 2005 low of 6000; calculated as 8500 - ( 11000 - 8500 ).

Today we closed above 9500 but if it can sustain that than only 10500 else retest of 9k and if that breaks 8.5K

Sunday, February 8

Nifty 50 Outlook and Stock Trading Ideas

Nifty is poised to open gap up tommorow BUt levels to be watched are 2889 and 2905 on closing basis

VIX index has broken out of range and is above 50 which is danger sign for bulls

TRIN and SCO widget have been added

SCO if above 98 is definatley a short and near 0 is a Long

Will write a details explanation on SCO and TRIN indcator

Members are not getting SMS on time so i will be posting Calls on SMS channel and simultaneously posting in Chat BOX in Blog so keep visiting the Blog in market hours if you are not getting SMS on time

Stock Specific

1.Relaince above 1365 cam see 1390 where it will face resistance above that 1425

2.SBIN Looks week on chart and raaly should be used to exit 1147 and 1192 can be reached But should be used to exit

3.JSW STEEL buy at 210 tgt 224 sl 200

4.Infosys above 1330 sl 1300 tgt 1368

5. Buying is advised in BOB if it crosses 250

6. Sell Punj Lolyd if it breaks 84 with a sl of 87 for a tgt of 77 and 73

We have taken positions in 2600 and 2700 PE keep a sl of 2909 on closing basis.

Happy Trading to all

Bramesh

9985711341

Sensex nad NIfty Outlook for 2009

The Nifty (Sensex) is in the process of completion of its correction from the 6200 (21000) levels. It seems currently to be in a

contracting triangle formation (lower tops & higher bottoms), the chances of which favour a downside breakdown with target marginally

south of 2000 (7000). This move should happen by April 2009.

Broader moves occur in a 5 wave sequence marked 1-2-3-4-5 with 2 correcting 1 and 4 correcting 3. Corrections happen in a 3 wave

sequence marked as A-B-C.

We presume we are currently in wave 4 of C of the bigger wave 4. The bigger wave 4 is the correction of wave 3 from 2003-2008 which

created a high of 6200 (21000). This will comprise of the A-B-C sequence . Wave A and B have already been completed (refer chart ) .C

will comprise of 5 waves of which 1-2-3 are complete, 4th is in progress and 5th to follow. Wave 5 is likely to take the Nifty (Sensex)

down to around 2000 (7000) levels. This five wave sequence would complete the correction A-B-C (as shown in chart) .

This presumption will be proven wrong if at any time now the Nifty (Sensex) breaches 3150 (10470) levels on the upside . A trend

reversal would occur if the Nifty (Sensex) were to move above 3150 (10470). The downside move in this case would be considered

complete at the OCT low of 2250 (7700).

The move to follow this downside will be a Five wave upmove. In the upmove we would expect the Nifty (Sensex) to reverse 50% -

62% of the entire fall from 6200 (21000) to 2200 (7700) (or a new low if created by April). By either calculation a minimum move to

around 4500 (15000) levels look possible. Timewise this should be possible in one year. This would make equity investments very

worthwhile.

The more aggressive could initiate protected shorts now to take advantage of the near 20% fall that we expect. They could go long at

lower levels.

Longer term investors could make staggered investments from current levels as the mid term market move is likely to provide decent

returns to all investing hereon.

Broadly despite our near term bearish outlook, we remain fairly optimistic on the prospective returns from equity for the year.

Compiled from a Brokerage Report

Saturday, February 7

Thursday, February 5

How to trade Gap Up's

The framework of the 'rule' has two phases:

1. The market generally will close at least 50% of an open-gap (i.e. an open that gaps above the previous close) in the first 60-minutes; and

2. If the market does not do this, we can expect a strong day in the direction of the gap.

The are a number of filters that I use:

* The setup does not work on every market. It works best in the S&P and 30-Year Bonds. I have not tried it on the 10-Year Notes and T-Bills. It does not work on Gold, and the Currencies.

* The open-gap must be at least mean +1 ATR of the current structure. If you are unfamiliar with Barros Swings, use a 40-day ATR.

* If at the end of 60-minutes, the market has not closed at least 50% of the open-gap but is trading near extreme closest to the 50%, I would wait another 30-minutes.

The tactics I use with the open-gap are many, especially when combined with some other tools:

* Market Delta Volume indications

* Market Profile ideas: open relationship with the previous day's value area; the type of open; where we are trading relative to the open-range of 5, 30 and 60-minutes intervals.

* Larger time frame context: for example prior to the open-gap, have the market ranges been compressing (this makes a trend day more likely) or they have been experiencing above average range days (this makes a rotational day likely and therefore 'fading' is likely to succeed).

What is fading? This brings me to the two general strategies.

The first and most common is to fade the open-gap and the second is to 'go-with' with the open-gap looking for a trend day. By 'fade' I mean take a contra open-gap trade; by 'go-with' I mean take a position in the direction of the gap.

If I am fading a gap, I will usually take a position in the second 5-minutes. As a rule with an open gap, the market will spend the first 5 minutes moving in the direction of the gap. 'Five minutes' is not a fast and hard time but rather an indication of some time spent. Here Market Delta volume and Open-Range ideas are very useful.

Here's an example for a 'fade' entry. Let's say that:

* The context would favour a rotational day. And,

* The market gaps up and nearing the end of the first 5-minutes, we see Market Delta Volume signifying at least a potential short-term top.

* The market then closes below the low of first 5-minutes bar.

In this situation, generally, I'll wait for a rotation back up to sell.As far as exit strategies for 'the fade' are concerned, here are some ideas:

* Stop: One place for the stop would be above the highs of the day plus filter

* Profit Target (core profit contract): a tick or two above the closing of the gap (if day-trading).

For trend days, if I were day trading, for core profit exits, I'd use a trailing stop and look to exit at 4:00 am EST - since a trend day usually closes in the extreme 25% of its range. Thus in an up day that has a range of 32 points, I'd expect the close to close within 8 points of the high.

Wednesday, February 4

Why the Dow is holding at 8,000

Closer examination, however, reveals that the bounces around the 8,000 mark are simply a function of the way the index is constructed. Because the Dow is price-weighted, it is also inherently flawed.

In Thoughts from the Frontline weekly newsletter dated Jan 23, writer John Mauldin correctly points out that the divisor for the DJIA is 7.964782, which means that for every dollar an index stock falls, the DJIA falls 7.964782 points, regardless of the stock's capitalisation.

As a result, if the stock of Microsoft, with a price of US$17 and a market cap of US$156 billion, was to crash to zero, the DJIA would only lose 135 points (17x7.964782). But if the same was to happen to IBM, with a smaller market cap of US$124 billion but a higher share price of US$92, it would cost the index to lose a whopping 700 points.

Now consider the four financial stocks currently in the DJIA - Citigroup (US$3.90), Bank of America (US$6.78) Amex (US$16.70) and JPMorgan (US$25.43) - using last Thursday's prices.

If all four stocks were to crash to zero, the DJIA would only lose 300 plus points, not that huge a loss in the context of the market, yet imagine the repercussions on the US and global economies if these four institutions collapsed totally.

Most of the news on Wall Street these days centres on the crippled financial and auto sectors. But because the share prices of these companies are now so low, these stocks do not affect the DJIA by much (General Motors' shares, for example, are now just above US$3).

In other words, because the index stocks most affected by bad news are already battered to rock-bottom levels, the DJIA doesn't seem to fall much when bad news is released, thus giving the mistaken impression of resilience to adverse news and of strong support around 8,000 points.

By right, these financial and auto stocks should have been removed from the index, given that it has been past practice to replace stocks whose prices drop below US$10.

For some reason, the DJIA's guardians have been reluctant to do the same now, possibly because of the political fallout that might ensue - imagine the repercussions of removing pillars like Citigroup or General Motors.

This then leads to the inevitable conclusions: the DJIA is not comparable over time; the only reason the DJIA appears well-supported around 8,000 is because the collapsed financial and auto components have not been replaced as they should have been; and that movements in large-price stocks are magnified because the index is heavily skewed in favour of these counters.

If the index was to be correctly re-balanced by removing the battered financials and autos and replacing them with stocks with prices above US$10, you'd have to wonder whether the 8,000 mark would hold as well as it has.

You'd also have to dismiss arguments that it is safe to buy since the index is at its lowest level in many years because historical comparisons are invalid - unless, of course, the same re-balancings that were done in the past are performed now.

Tuesday, February 3

Dow Jones Industrial Average short to medium term view

The Dow respected resistance at 8400, signaling selling pressure, and is now testing support at 7900/8000. Declining volume indicates that support is weakening. Failure would signal another test of the November low of 7500, while respect of support would again test 8400. In the long term, breakout below 7500 would offer a target of 6000; calculated as 7500 - ( 9000 - 7500 ). Confirmed if the 2002 low of 7300 is penetrated.

Monday, February 2

Nifty 50 Turning Bearish

Hi all

Was very Busy yesterday not able to post weekly calls

Hope u all are happy with sms service.

Nifty Bullish set up which was formed yesterday all went in wind as today due to week global cues Nifty went down almost 3%.Now as from my previous chart Nifty is making lower Highs and is probably will make lower lows.

Reliance despite of good news today did not run up.Relance now has support at 1230 (20EMA)

Dow zones has broken an important support of 8000 ans as i write it is down almost 80 points.S&P Index is very near to its crucial level of 800

So i am negative in market but lets see if market is able to break tge lower range of 2670.

Trading Ideas

RELIANCE COMMUNICATION SELL IF BREAKS 155 147 and 140 SL 159

TATA STEEL SELL BELOW 175 TGt 165 and 155

Regards,

Bramesh

09985711341

How Wall Street Keeps Dooming Itself

The bankers are bellyaching about a 44 percent decline in bonuses from 2007 levels. That's like complaining about being served a 40-ounce porterhouse instead of a 70-ounce one.

Here's a bit more perspective: Charles Payne, CEO of the research firm Wall Street Strategies, points out that in 1985, Wall Street bonuses totalled $1.9 billion. The average recipient got $13,970. Since 1985, inflation has run 97 percent in total, according to the Bureau of Labor Statistics. That means that something worth $1 in 1985 would be worth $1.97 today. So follow the math:

Wall Street bonus pool in 1985: $1.9 billion

Value in 2008, if indexed for inflation: $3.75 billion

Actual 2008 bonus pool: $18.4 billion

Amount by which bonus pool exceeded inflation: 490 percent

Average Wall Street bonus, 1985: $13,970

Value in 2008, if indexed for inflation: $27,580

Actual average bonus, 2008: $112,000

Amount by which average bonus exceeded inflation: 406 percent

So pay for top Wall Streeters has risen 4 to 5 times as much as the rate of inflation since 1985. Of course those bankers are worth it, because of all the great things they've done for America during that time, like engineer the Long-Term Capital Management meltdown in 1998, the tech bubble that burst in 2001, the housing bubble that's still bursting, a credit freeze that's producing hypothermia at hundreds of real companies that actually make stuff, and the near collapse of the financial markets.

If there's a crowning absurdity, it's that Wall Street mustered any bonuses at all in a year when the industry lost $34 billion. Does anybody else in America get a bonus when their company tanks? "Rewarding cataclysmic failure like this has to be what led to the fall of the Roman Empire," Payne wrote in a recent note to clients.

It's worth pointing out that not all Wall Street firms are as wayward as big offenders like Citigroup (C), Merrill Lynch (MER), AIG (AIG), and Bank of America (BAC). Many made money in 2008, and any firm that isn't asking for taxpayer handouts should be allowed to pay its people whatever it wants.

But the bonus brouhaha reveals so many disconnects in the financial industry that it could end up being a pivotal moment in the dismantling of the old Wall Street. Derivatives and "funding facilities" are hard for most people to understand. But gimme gimme gimme is a corruption we all understand. If the politicians didn't have a clear rallying cry for going after Wall Street before, they sure do now.